The Franco-German Ministerial Council announced a joint Economic Agenda aiming to strengthen the bilateral partnership in strategic areas, and to foster sovereignty in Europe. The Agenda proposes ‘flagship projects’ across key policy fields like energy, trade, industry, cutting-edge technologies, digital sovereignty, labour, and finance.

The document mainstreams the importance of digital sovereignty and advanced technologies, as Europe faces growing geopolitical and economic pressures. A key milestone will be the European Digital Sovereignty Summit on 18 November 2025, which aims to align EU institutions, member states, industry, and other stakeholders around a shared strategy for digital sovereignty and coordinated funding.

Both governments also committed to strengthening cloud sovereignty, with special attention paid to sensitive data and jurisdiction issues.

Within the context of the public administration, the agenda promotes closer alignment of digital workplace tools, such as France’s ‘La Suite numérique’ and Germany’s ‘OpenDesk’, with the ambition of building a Franco-German digital ecosystem for public services.

Paris and Berlin will also submit a joint proposal to the European Commission to simplify and better coordinate EU regulations in AI, cybersecurity, and data areas.

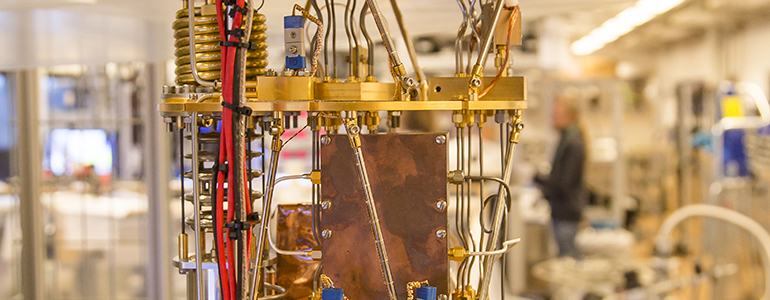

The two countries committed to strengthening joint efforts in AI, quantum computing, cloud, and space technologies, supporting collaborative research and industrial projects.

The Agenda combines bilateral cooperation on infrastructure and governance, aiming to strengthen Europe’s technological sovereignty.

Would you like to learn more about AI, tech and digital diplomacy? If so, ask our Diplo chatbot!