UN Secretary-General António Guterres has urged world leaders to act swiftly to ensure AI serves humanity rather than threatens it. Speaking at a UN Security Council debate, he warned that while AI can help anticipate food crises, support de-mining efforts, and prevent violence, it is equally capable of fueling conflict through cyberattacks, disinformation, and autonomous weapons.

‘Humanity’s fate cannot be left to an algorithm,’ he stressed.

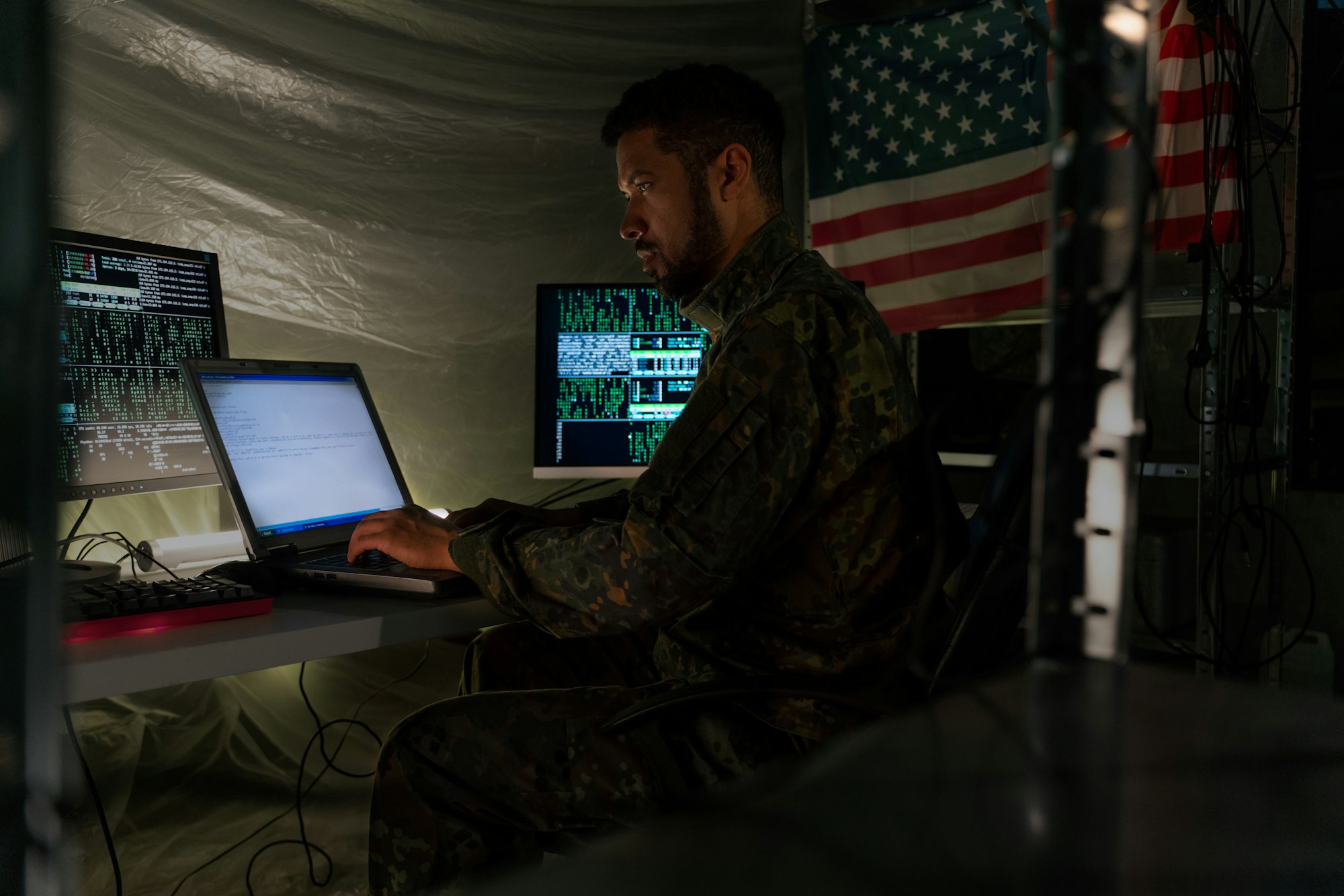

Guterres outlined four urgent priorities. First, he called for strict human oversight in all military uses of AI, repeating his demand for a global ban on lethal autonomous weapons systems. He insisted that life-and-death decisions, including any involving nuclear weapons, must never be left to machines.

Second, he pressed for coherent international regulations to ensure AI complies with international law at every stage, from design to deployment. He highlighted the dangers of AI lowering barriers to acquiring prohibited weapons and urged states to build transparency, trust, and safeguards against misuse.

Finally, Guterres emphasised protecting information integrity and closing the global AI capacity gap. He warned that AI-driven disinformation could destabilise peace processes and elections, while unequal access risks leaving developing countries behind.

The UN has already launched initiatives, including a new international scientific panel and an annual AI governance dialogue, to foster cooperation and accountability.

‘The window is closing to shape AI, for peace, justice, and humanity,’ he concluded.

For more information from the 80th session of the UN General Assembly, visit our dedicated page.

Would you like to learn more about AI, tech and digital diplomacy? If so, ask our Diplo chatbot!