South Korea’s new Science and ICT Minister, Bae Kyung-hoon, has pledged to turn the nation into one of the world’s top three AI powerhouses.

Instead of following outdated methods, Bae outlined a bold national strategy centred on AI, science and technology, aiming to raise Korea’s potential growth rate to 3 per cent and secure a global economic leadership position.

Bae, a leading AI expert and former president of LG AI Research, officially assumed office on Thursday.

Drawing from experience developing hyperscale AI models like LG’s Exaone, he emphasised the need to build a unique competitive advantage rooted in AI transformation, talent development and technological innovation.

Rather than focusing only on industrial growth, Bae’s policy agenda targets a broad AI ecosystem, revitalised research and development, world-class talent nurturing, and addressing issues affecting daily life.

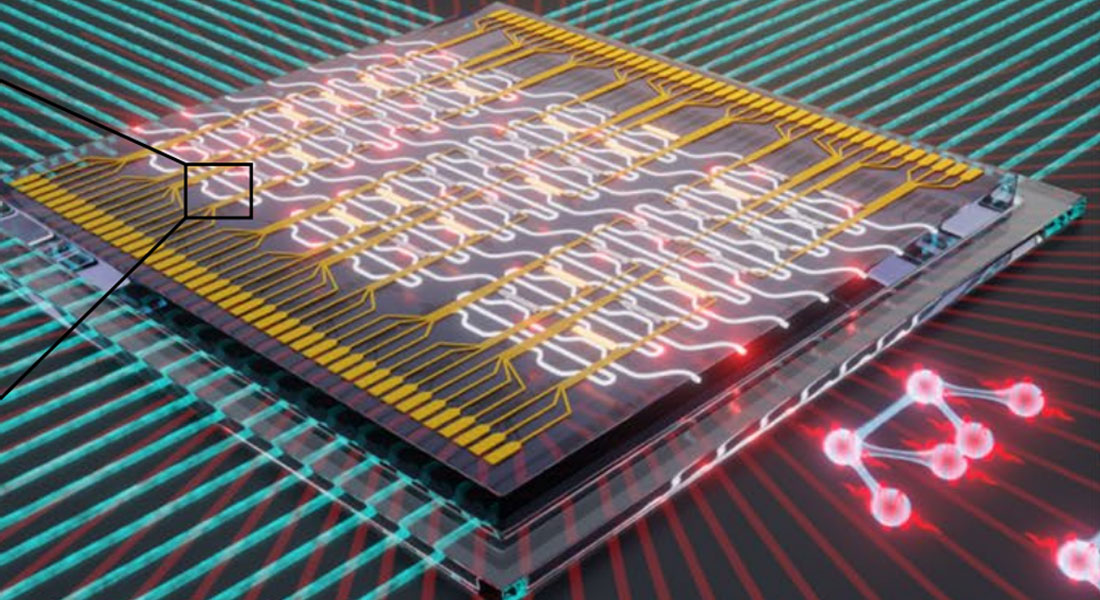

His plans include establishing AI-centred universities, enhancing digital infrastructure, promoting AI semiconductors, restoring grassroots research funding, and expanding consumer rights in telecommunications.

With these strategies, Bae aims to make AI accessible to all citizens instead of limiting it to large corporations or research institutes. His vision is for South Korea to lead in AI development while supporting social equity, cybersecurity, and nationwide innovation.

Would you like to learn more about AI, tech and digital diplomacy? If so, ask our Diplo chatbot!