Researchers have advanced an AI system designed to detect bacterial contamination in food, dramatically improving accuracy and speed. The upgraded tool distinguishes bacteria from microscopic food debris, reducing diagnostic errors in automated screening.

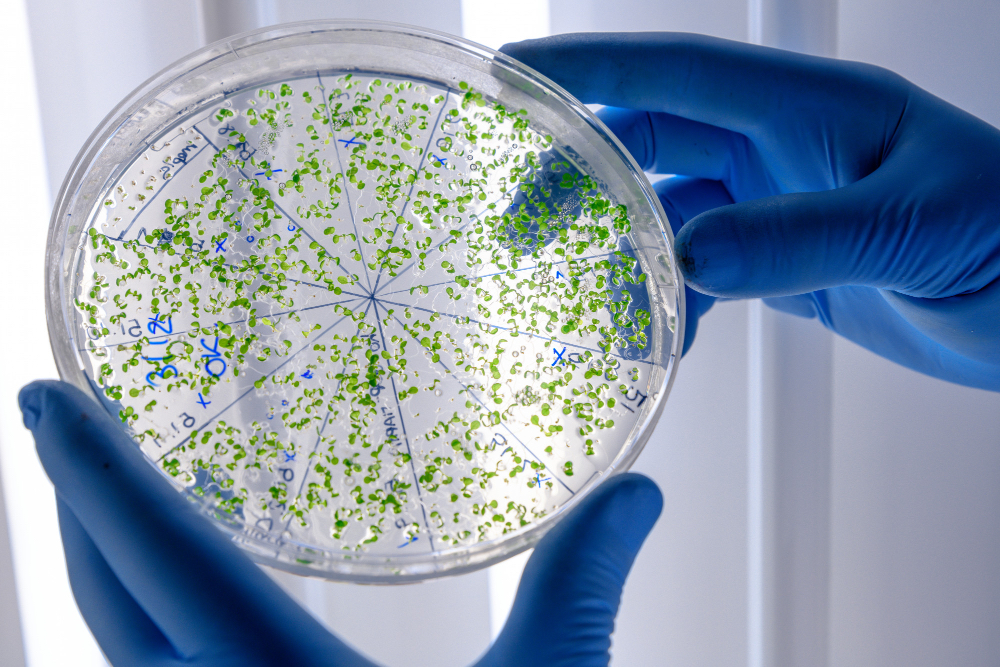

Traditional testing relies on cultivating bacterial samples, taking days, and requiring specialist laboratory expertise. The deep learning model analyses bacterial microcolony images, enabling reliable detection within about three hours.

Accuracy gains stem from expanded model training. Earlier versions, trained solely on bacterial datasets, misclassified food debris as bacteria in more than 24% of cases.

Adding debris imagery to training eliminated misclassifications and improved detection reliability across food samples. The system was tested on pathogens including E. coli, Listeria, and Bacillus subtilis, alongside debris from chicken, spinach, and cheese.

Researchers say faster, more precise early detection could reduce foodborne outbreaks, protect public health, and limit costly product recalls as the technology moves toward commercial deployment.

Would you like to learn more about AI, tech and digital diplomacy? If so, ask our Diplo chatbot!