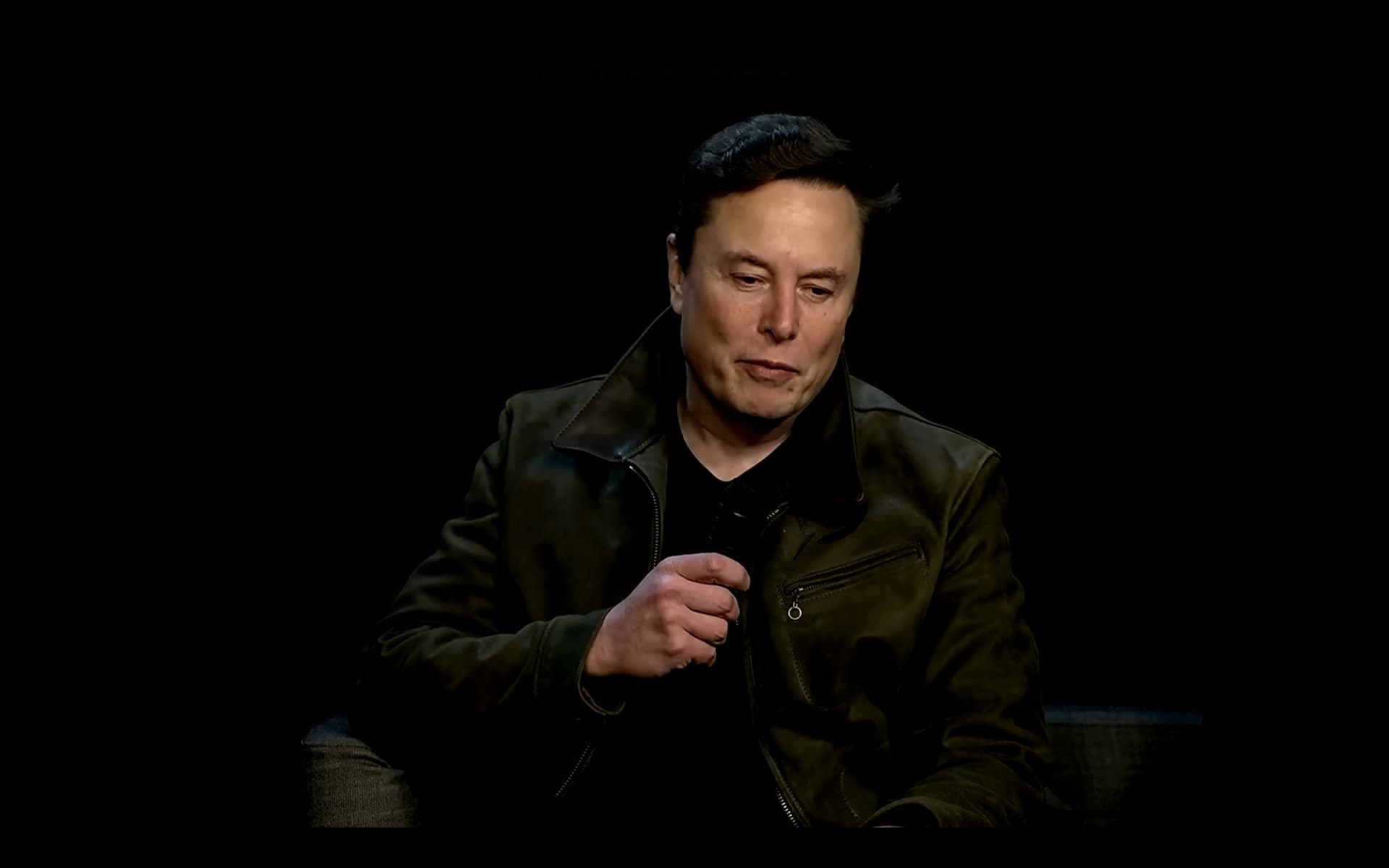

Elon Musk’s xAI has filed a lawsuit in Texas accusing Apple and OpenAI of colluding to stifle competition in the AI sector.

The case alleges that both companies locked up markets to maintain monopolies, making it harder for rivals like X and xAI to compete.

The dispute follows Apple’s 2024 deal with OpenAI to integrate ChatGPT into Siri and other apps on its devices. According to the lawsuit, Apple’s exclusive partnership with OpenAI has prevented fair treatment of Musk’s products within the App Store, including the X app and xAI’s Grok app.

Musk previously threatened legal action against Apple over antitrust concerns, citing the company’s alleged preference for ChatGPT.

Musk, who acquired his social media platform X in a $45 billion all-stock deal earlier in the year, is seeking billions of dollars in damages and a jury trial. The legal action highlights Musk’s ongoing feud with OpenAI’s CEO, Sam Altman.

Musk, a co-founder of OpenAI who left in 2018 after disagreements with Altman, has repeatedly criticised the company’s shift to a profit-driven model. He is also pursuing separate litigation against OpenAI and Altman over that transition in California.

Would you like to learn more about AI, tech and digital diplomacy? If so, ask our Diplo chatbot!