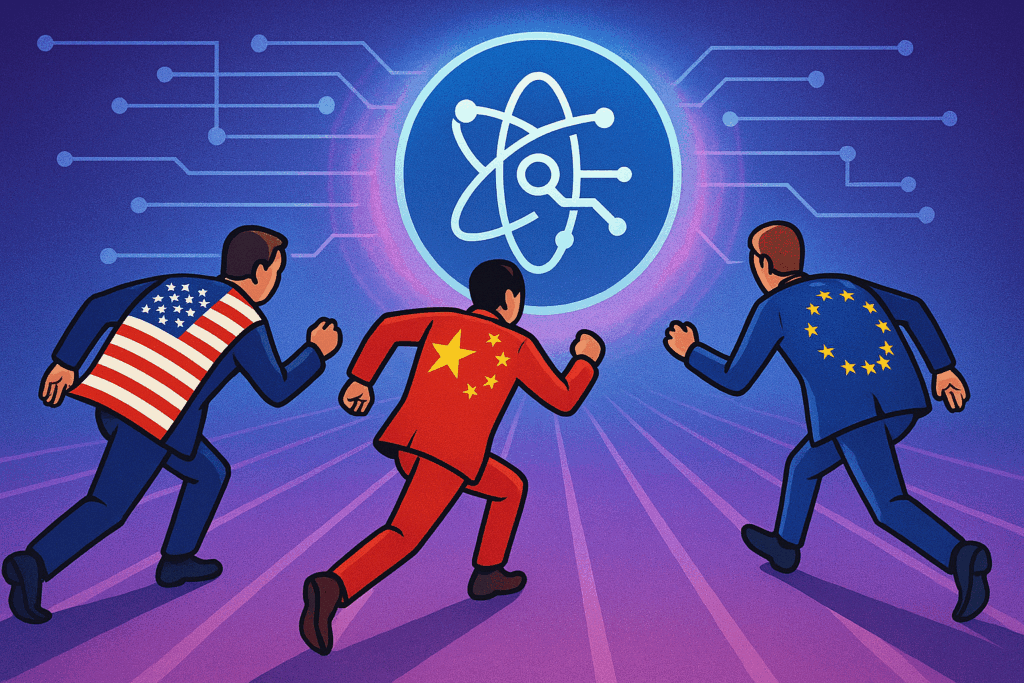

Europe’s quantum ambitions meet US private power and China’s state drive

Quantum computing promises a transformative shift, accelerating AI, challenging encryption, and revolutionizing industries globally.

Quantum computing could fundamentally reshape technology, using quantum bits (qubits) instead of classical bits. Qubits allow complex calculations beyond classical computing, transforming sectors from pharmaceuticals to defence.

Europe is investing billions in quantum technology, emphasising technological sovereignty. Yet, it competes fiercely with the United States, which enjoys substantial private investment, and China, powered by significant state-backed funding.

The UK began quantum initiatives early, launching the National Quantum Programme 2014. It recently pledged £2.5 billion more, supporting start-ups like Orca Computing and Universal Quantum, alongside nations like Canada, Israel, and Japan.

Europe accounted for eight of the nineteen quantum start-ups established globally in 2024, including IQM Quantum Computers and Pasqal. Despite Europe’s scientific strengths, it only captured 5% of global quantum investments, versus 50% for the US.

The European Commission aims to strengthen quantum capabilities by funding six chip factories and a continent-wide Quantum Skills Academy. However, attracting sufficient private investment remains a significant challenge.

The US quantum industry thrives, driven by giants such as IBM, Google, Microsoft, IonQ, Rigetti, and D-Wave Quantum. Recent breakthroughs include Microsoft’s topological qubit and Google’s Willow quantum chip.

D-Wave Quantum has demonstrated real-world quantum advantages, solving complex optimisation problems in minutes. Its technology is now used commercially in logistics, traffic management, and supply chains.

China, meanwhile, leads in state-driven quantum funding, investing $15 billion directly and managing a $138 billion tech venture fund. By contrast, US federal investment totals about $6 billion, underscoring China’s aggressive approach.

Global investment in quantum start-ups reached $1.25 billion in Q1 2025 alone, reflecting a shift towards practical applications. By 2040, the quantum market is projected to reach $173 billion, influencing global economics and geopolitics.

Quantum computing raises geopolitical concerns, prompting democratic nations to coordinate through bodies like the OECD and G7. Interoperability, trust, and secure infrastructure have become essential strategic considerations.

Europe’s quantum ambitions require sustained investment, standard-setting leadership, and robust supply chains. Its long-term technological independence hinges on moving swiftly beyond initial funding towards genuine strategic autonomy.

Would you like to learn more about AI, tech and digital diplomacy? If so, ask our Diplo chatbot!