AI demand squeezes memory supply, putting mid-range phones at risk

Artificial intelligence’s booming demand for advanced memory is tightening global memory chip supplies, driving up prices and putting pressure on mid-range smartphones and PCs.

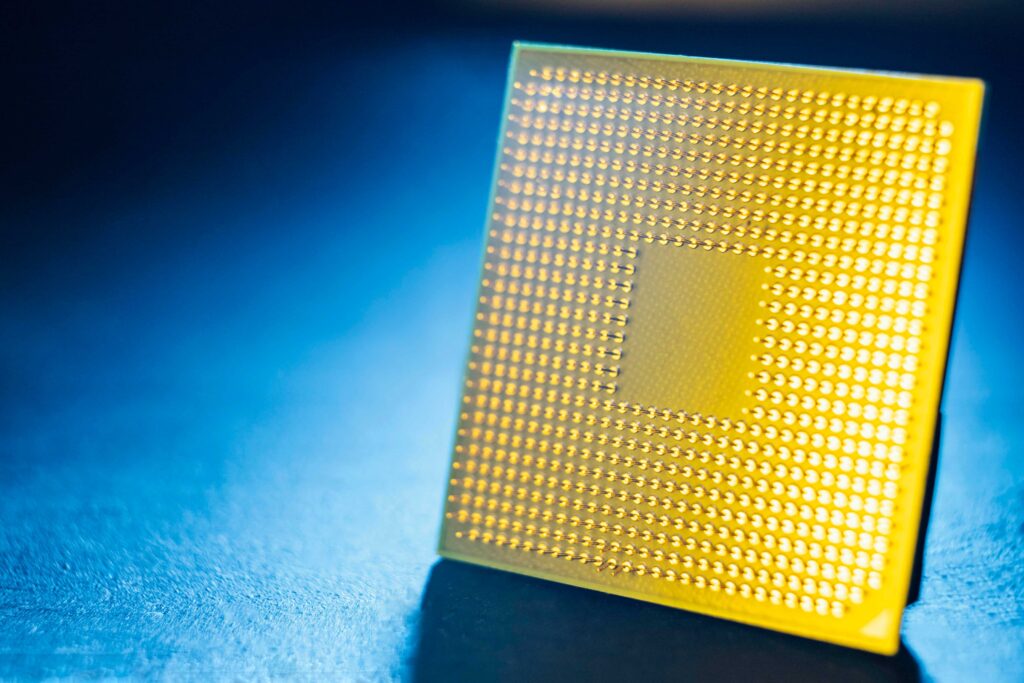

The rapid expansion of AI infrastructure, especially high-bandwidth memory (HBM) used in data centres and AI accelerators, is causing memory chip makers to prioritise production capacity for high-margin AI-related products, squeezing the supply of traditional DRAM and NAND used in consumer devices like smartphones, tablets and PCs.

Industry leaders, including Samsung, SK Hynix and Micron, are shifting wafer capacity toward AI-grade memory, and major cloud and hyperscale buyers (e.g., Nvidia, AWS, Google) are securing supply through long-term contracts, which reduces available inventory for mid-tier device manufacturers.

As a result, memory pricing has climbed sharply, forcing consumer electronics makers to raise retail prices, cut specs or downgrade other components to maintain margins.

Analysts warn the mid-range smartphone segment, typically priced between roughly $400–$600, faces a particular squeeze, with fewer compelling devices expected and slower spec improvements, as memory becomes a dominant cost driver and supply constraints persist.

Would you like to learn more about AI, tech and digital diplomacy? If so, ask our Diplo chatbot!