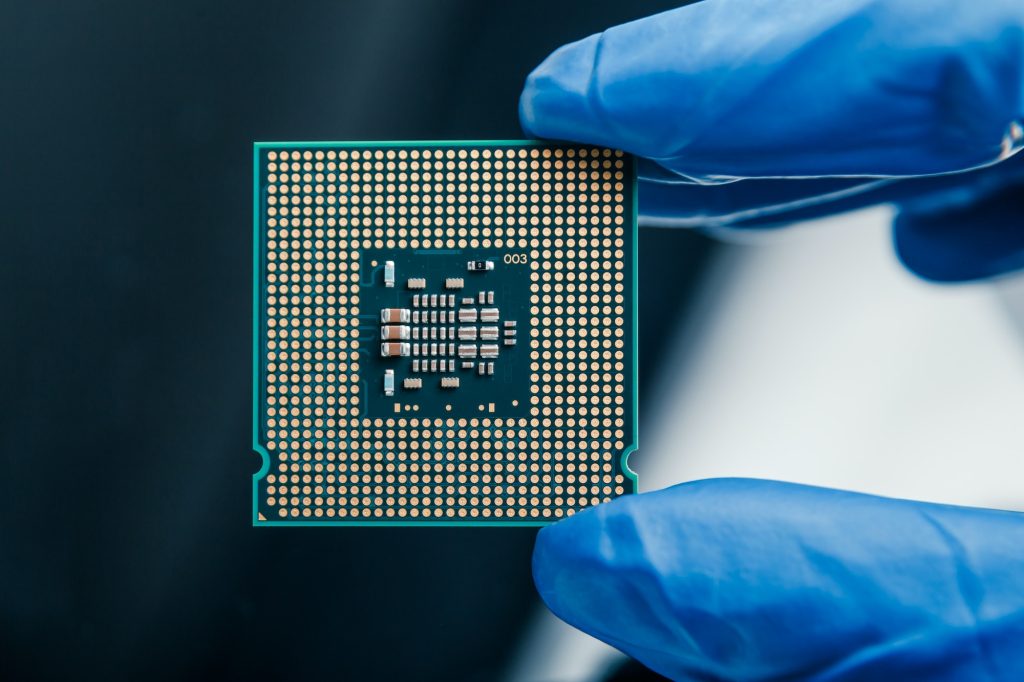

Taiwanese chip maker Vanguard warns of economic risks from US tariffs

Economic risks may arise from tariffs, though the direct impact on Vanguard is expected to be minimal.

Vanguard International Semiconductor has cautioned that US tariffs on imported chips may drive inflation and weaken global economic growth.

Chairman Leuh Fang stated that while the direct impact on Vanguard would be minimal, broader consequences for the semiconductor industry remain uncertain.

The company remains in a wait-and-see mode, as it is unclear how far the proposed tariffs will go. Higher import duties could reduce purchasing power and slow economic expansion, Fang noted.

However, the firm expects little direct exposure to the tariffs due to its focus on legacy chips for automotive and display applications.

Vanguard has no plans to establish a US manufacturing facility. Meanwhile, larger industry players such as TSMC, which owns over a quarter of Vanguard’s shares, are investing in American production to navigate trade uncertainties.

For more information on these topics, visit diplomacy.edu.