AI data centre boom drives global spike in memory chip prices

Samsung and others hike memory prices amid extreme data centre demand.

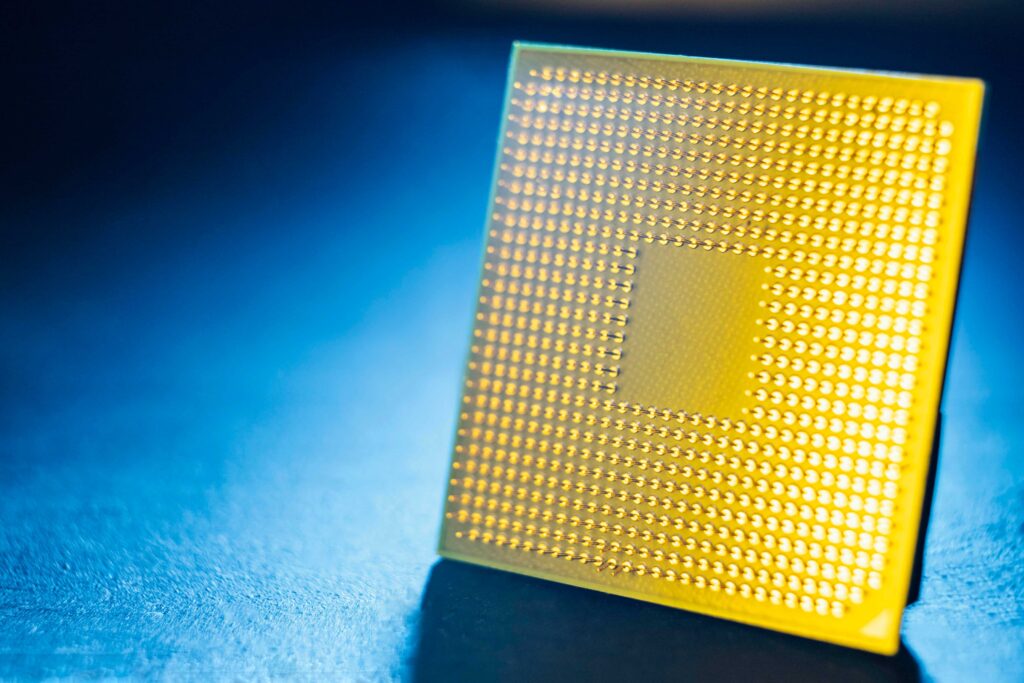

The rapid expansion of AI data centres is pushing up memory chip prices and straining an already tight supply chain. DRAM costs are rising as manufacturers prioritise high-bandwidth memory for AI systems, leaving fewer components available for consumer devices.

The shift is squeezing supply across sectors that depend on standard DRAM, from PCs and smartphones to cars and medical equipment. Analysts say the imbalance is driving up component prices quickly, with Samsung reportedly raising some memory prices by as much as 60%.

Rising demand for HBM reflects the needs of AI clusters, which rely on vast memory pools alongside GPUs, CPUs and storage. But with only a handful of major suppliers, including Samsung, SK Hynix, and Micron, the surge is pushing prices across the market higher.

Industry researchers warn that rising memory costs will likely be passed on to consumers, especially in lower-priced laptops and embedded systems. Makers may switch to cheaper parts or push suppliers for concessions, but the overall price trend remains upward.

While memory is known for cyclical booms and busts, analysts say the global race to build AI data centres makes it difficult to predict when supply will stabilise. Until then, higher memory prices look set to remain a feature of the market.

Would you like to learn more about AI, tech, and digital diplomacy? If so, ask our Diplo chatbot!