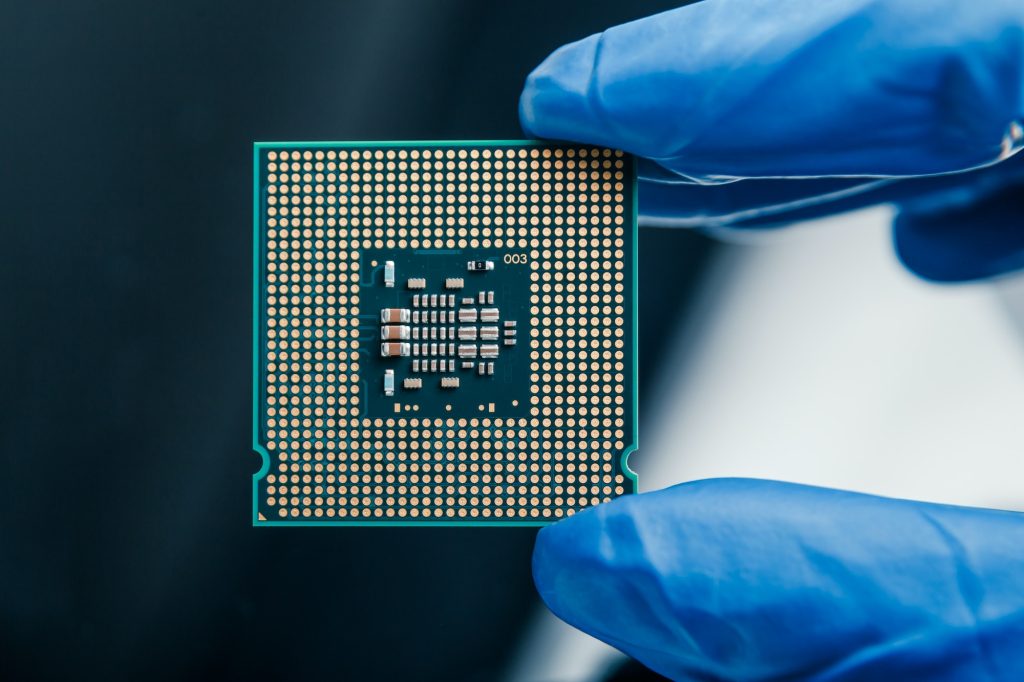

Chip stocks rise as US restrictions on China may ease

ASML and rivals gain amid China trade speculation.

European chip equipment stocks surged on Thursday following reports that upcoming US restrictions on China’s semiconductor industry might be less stringent than anticipated. Shares of ASML, a leading supplier of semiconductor tools, rose by 4.3%, while competitors BE Semiconductor and ASM International climbed 5% and 2.9%, respectively, outperforming the STOXX 600 index.

According to Bloomberg, the US may exclude Chinese memory chipmaker ChangXin Memory Technologies (CXMT) from its trade restrictions, though details remain uncertain. The US Commerce Department, which oversees export rules, is expected to release updated guidance after Thanksgiving.

ASML, which has seen a sharp decline in sales to China over recent quarters, declined to comment. The company previously projected that sales to China would shrink to 20% of its revenue by 2025, down from nearly half in the last 18 months. Other global semiconductor equipment suppliers, including US-based Applied Materials and Tokyo Electron, are also closely monitoring the situation.