Financing mechanisms for locally-owned internet networks

2 Dec 2022 06:30h - 08:00h

Event report

The meeting drew on the report, ‘Financing mechanisms for locally owned internet infrastructure’, published by Connectivity Capital in partnership with the Association for Progressive Communication, Internet Society, and Connect Humanity to increase awareness of financing models available to community-owned networks in connecting the 2.9 billion in the last mile.

Initial discussions covered the structure and goals of community connectivity providers (CCPs) and current business models, highlighting the work of Tunapona, a CCP in Nairobi, Kenya. CCPs fall into three categories: community networks, municipal networks, and social enterprise networks. By definition, according to the report under consideration, CCPs are ‘locally-owned and operated networks that fill gaps and provide access where traditional telecommunication networks do not’. They deploy wired, wireless, or fibre networks, retail, wholesale, or hybrid options. Network type can also change over time.

Each type of network has unique advantages and disadvantages. For instance, municipal CCPs can access government funding easier than other types, whereas community CCPs may find it difficult initially to convince investors to come on board. However, common to all networks is community ownership, the reinvestment of profits back into the community, and a social bottom line.

The choice to set up a specific type of network usually depends on a number of factors, including the legal, geographical, socio-cultural, and infrastructural context, and the context best suited for sustainability and the intended focus. Tunaponda, a community network in Kenya, for instance, has built ‘a digital ecosystem in education, health, business, and CBOs around Kibera’. The organisation focuses on connecting centres to the internet, offering services in the area of capacity building and supporting clusters of community networks. Despite their differences all CCPs require on-going access to capital.

Networks start up, operate, and sustain themselves with various forms of capital, depending on their stage of development, whether starting, sustaining, expanding, or maturing. Financial mechanisms for start-ups and those in the sustaining phase include grant funding and angel or community investments including sweat equity. Debt and equity capital normally feature at the expanding and maturing phases.

The financial pathway for CCPs depends on their financial sustainability, and financing can be derived from commercial and non-commercial sources, including tax credits, broadband vouchers, concessional loans, guarantees, risk free rates, bonds, bank and vendor loans, and angel and venture capital. De-risking strategies can also result in savings. These include demand aggregation, buying in bulk, better pricing; pre-sale, down payments, anchor tenant contracts, credit enhancement/loss, guarantees schemes, risk-sharing, novel forms of collateral, and investment in digital literacy and community engagement. The greater the blend of capital streams the lesser the risk to the going concern.

Each stage also possesses other unique characteristics that influence their capital and operational structure. Workers in early stage entities are usually jacks-of-all-trade, and focus primarily on funding opportunities. Those in later stages are often domain experts and are able to focus on the human side of the venture. Although they are best positioned to cater to community connectivity needs, CCPs require knowledge brokers when negotiating with potential investors/funders. CCPs should also employ entrepreneurial practices such as: market research, public-private partnerships, networking, impact assessments, cost-benefit and risk analyses, and advocate governments for the removal of other forms of barriers to achieve their goals sustainably.

By Alicia Shepherd

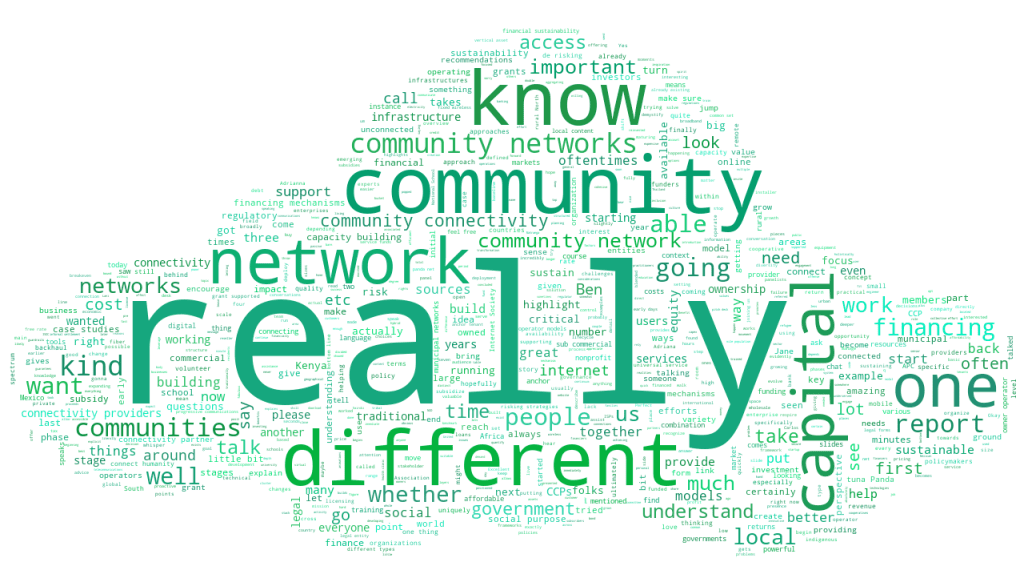

The session in keywords

Related topics

Related event